Yes! You can use AI to fill out Form 5329, Additional Taxes on Qualified Plans

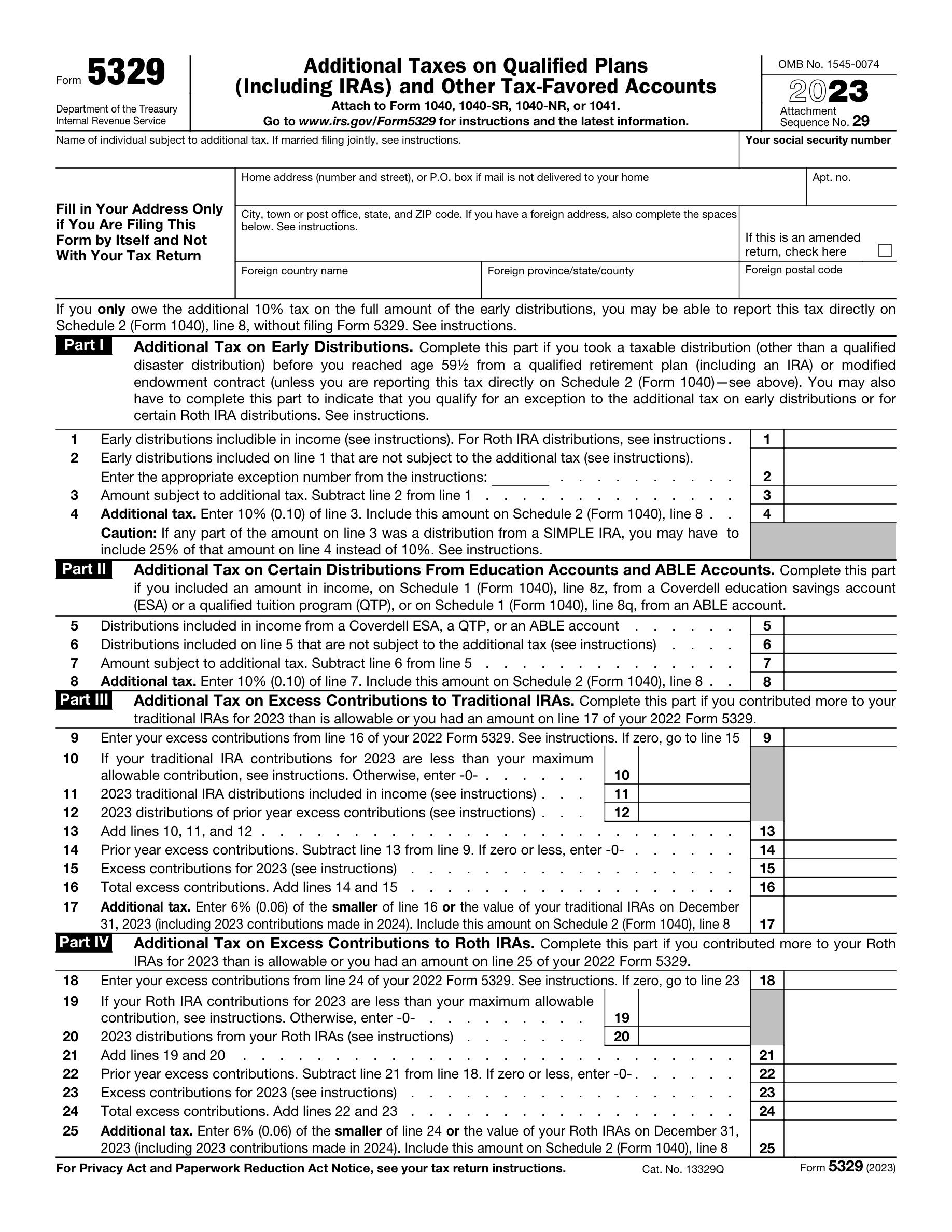

Form 5329, Additional Taxes on Qualified Plans, is used to report additional taxes owed on early distributions from retirement accounts. It is important for taxpayers to fill out this form to accurately report any additional taxes due and avoid penalties.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 5329 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 5329, Additional Taxes on Qualified Plans |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 73 |

| Number of pages: | 2 |

| Version: | 2023 |

| Official download URL: | https://www.irs.gov/pub/irs-pdf/f5329.pdf |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 5329 Online for Free in 2025

Are you looking to fill out a 5329 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2025, allowing you to complete your 5329 form in just 37 seconds or less.

Follow these steps to fill out your 5329 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 5329.

- 2 Enter your personal information and address.

- 3 Complete the relevant sections for additional taxes.

- 4 Sign and date the form electronically.

- 5 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 5329 Form?

Speed

Complete your Form 5329 in as little as 37 seconds.

Up-to-Date

Always use the latest 2025 Form 5329 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 5329

Form 5329 is used to report additional taxes on early distributions from qualified plans, including IRAs, as well as on certain distributions from education accounts and ABLE accounts. It is also used to report excess contributions to traditional and Roth IRAs, Coverdell ESAs, Archer MSAs, and Health Savings Accounts.

Individuals who have taken a taxable distribution from a qualified retirement plan, including an IRA, or from a Coverdell education savings account, a qualified tuition program, or an ABLE account before reaching age 59 ½, or who have made excess contributions to traditional or Roth IRAs, Coverdell ESAs, Archer MSAs, or Health Savings Accounts are required to file Form 5329.

Form 5329 should be filed with your annual tax return, typically by April 15 of the following year. However, if you are filing an extension, the deadline for filing Form 5329 is also extended.

Part I of Form 5329 is used to report additional taxes on early distributions from qualified plans, including IRAs. You are required to report the total amount of early distributions, the amount that is not subject to the additional tax, and the exception number if you qualify for an exception to the additional tax.

The additional tax rate on early distributions from a qualified plan is 10%.

Corrections to Form 5329 should be made as soon as possible and no later than the due date of your tax return for the year in which the error occurred. If you are filing an extension, the deadline for making corrections is the due date of your extended return.

The penalty for failing to file Form 5329 is 10% of the amount of the tax not paid, for each month that the failure continues, up to a maximum of 25% of the tax.

The maximum contribution limit for traditional and Roth IRAs in 2023 is $6,500, or $7,500 if you are age 50 or older.

The maximum contribution limit for Coverdell ESAs in 2023 is $2,500 per beneficiary.

The maximum contribution limit for Archer MSAs in 2023 is $3,650 for self-only coverage and $7,300 for family coverage.

The maximum contribution limit for Health Savings Accounts in 2023 is $3,600 for self-only coverage and $7,300 for family coverage.

Compliance Form 5329

Validation Checks by Instafill.ai

1

Form Attachment Verification

Ensures that the Additional Taxes on Qualified Plans form is properly attached to the appropriate income tax return form, such as Form 1040, 1040-SR, 1040-NR, or 1041, when required. If the form is being filed independently, it confirms that the taxpayer's address and signature are duly provided on Form 5329. This check is crucial to ensure compliance with IRS filing procedures and to avoid processing delays.

2

Early Distribution Calculation

Confirms that Part I - Additional Tax on Early Distributions is accurately calculated. It verifies the total early distributions that are includible in income, ensuring that the figures reported are correct and substantiated by the appropriate documentation. This validation is essential to prevent errors that could result in incorrect tax calculations and potential penalties.

3

Non-Taxable Amount Identification

Verifies that the amount not subject to the additional tax in Part I is correctly identified and that the corresponding exception number is provided. This check is important to ascertain that only the eligible distributions are excluded from the additional tax, thereby ensuring the accuracy of the taxable income reported on the form.

4

Taxable Amount Computation

Calculates the amount subject to additional tax in Part I by subtracting the non-taxable amount from the total early distributions. This computation is vital to determine the correct base for the additional tax, ensuring that the taxpayer is neither overpaying nor underpaying the tax due.

5

Additional Tax Inclusion

Computes the additional tax as 10% of the taxable amount in Part I and ensures that this tax is correctly included on Schedule 2 (Form 1040), line 8. This validation confirms that the additional tax due is accurately reflected in the taxpayer's overall tax liability, which is critical for the final tax assessment.

6

Correct Entry of Distributions

Ensures that distributions reported from Coverdell ESA, QTP, or an ABLE account in Part II are entered accurately. The AI cross-references the amounts with the corresponding documentation to confirm their validity. It checks for common input errors and discrepancies that could lead to incorrect tax calculations. The AI also alerts the user if the reported distributions do not align with the expected figures based on the account type.

7

Non-Taxable Amount Calculation

Verifies the amount from Part II line 5 that is not subject to the additional tax and ensures the calculation is accurate. The AI reviews the criteria for non-taxable distributions, applying the relevant tax laws and regulations. It automatically performs the necessary subtractions and cross-checks the results to prevent any computational errors. The AI also provides a summary of the non-taxable amount for user confirmation.

8

Taxable Amount Determination

Calculates the amount subject to additional tax in Part II by subtracting the non-taxable amount from the total distributions. The AI uses advanced algorithms to ensure that the subtraction is performed correctly and that the taxable amount is clearly identified. It also validates that the correct figures are carried over to subsequent calculations, maintaining the integrity of the entire form.

9

Additional Tax Computation

Computes the additional tax as 10% of the taxable amount in Part II and ensures it is included on Schedule 2 (Form 1040), line 8. The AI applies the appropriate tax rate, checks for rounding issues, and verifies that the calculated tax is accurately reflected on the required line of Schedule 2. It also confirms that the additional tax is consistent with the taxpayer's overall tax liability.

10

Excess Contributions Tax Calculation

Follows the detailed instructions to calculate and report any additional tax on excess contributions to traditional IRAs in Part III. The AI interprets the instructions to identify excess contributions and uses historical data to validate the year of the contribution. It calculates the additional tax due, if any, and ensures that this amount is correctly reported on the form, providing a clear audit trail for the user.

11

Ensures accurate calculation and reporting of additional tax on excess contributions to Roth IRAs in Part IV

The software ensures that the calculations for additional tax on excess contributions to Roth IRAs are accurate by cross-verifying the contribution amounts with the applicable limits for the tax year. It also ensures that the correct tax rate is applied to any excess contributions. The software checks that the reported amounts in Part IV of the form align with the calculated values and alerts the user to any discrepancies. Additionally, it confirms that the final tax amount is correctly carried over to other relevant sections of the form, if necessary.

12

Verifies the calculation and reporting of additional tax on excess contributions to Coverdell ESAs in Part V

The software verifies that the calculation of additional tax on excess contributions to Coverdell Education Savings Accounts (ESAs) is done correctly by checking the contribution amounts against the annual limits. It applies the appropriate tax rate to any contributions that exceed the limit. The software ensures that these figures are reported accurately in Part V of the form and that any errors are highlighted for correction. It also confirms that the total additional tax is properly included in the sum of taxes due on the form.

13

Checks for correct calculation and reporting of additional tax on excess contributions to Archer MSAs in Part VI

The software checks for the correct calculation of additional tax on excess contributions to Archer Medical Savings Accounts (MSAs) by ensuring contributions do not exceed the set limits for the tax year. It calculates the additional tax using the correct rate for any excess amounts. The software reviews the reporting of these figures in Part VI, ensuring accuracy and completeness. It also verifies that the total tax due to excess contributions is accurately reflected in the form's summary of taxes owed.

14

Confirms the calculation and reporting of additional tax on excess contributions to Health Savings Accounts (HSAs) in Part VII

The software confirms that the calculation of additional tax on excess contributions to Health Savings Accounts (HSAs) is correct by comparing the contributions to the statutory limits. It ensures the proper tax rate is applied to any excess contributions and that these amounts are accurately reported in Part VII of the form. The software checks for any mathematical errors and ensures that the total additional tax is correctly included in the overall tax calculation on the form.

15

Ensures the calculation and reporting of additional tax on excess contributions to an ABLE account in Part VIII are correct

The software ensures that the calculation of additional tax on excess contributions to an Achieving a Better Life Experience (ABLE) account is accurate. It does this by confirming that contributions are within the annual contribution limits and applying the correct tax rate to any excess. The software meticulously checks that these amounts are reported correctly in Part VIII and that the total additional tax is properly accounted for in the final tax figures on the form.

16

Verifies the calculation and reporting of additional tax on excess accumulation in qualified retirement plans in Part IX

Ensures that the calculations for additional tax on excess accumulations in qualified retirement plans are accurate and correctly entered in Part IX of the form. It cross-references the reported amounts with the taxpayer's documentation to confirm the validity of the figures. The software also checks for common mathematical errors and alerts the user to any discrepancies that may arise during the calculation process. This validation is crucial to avoid potential penalties or issues with the IRS due to incorrect reporting of additional taxes.

17

Confirms that the form is signed and dated by the taxpayer and, if applicable, by the paid preparer in the 'Paid Preparer Use Only' section

Verifies that the form has been duly signed and dated by the taxpayer, ensuring that the submission is authorized and valid. In cases where a paid preparer is involved, the software also checks that the 'Paid Preparer Use Only' section is completed with the preparer's signature and date. This step is essential for the form's legality and may prevent it from being rejected due to missing signatures. The software also reminds users if the signature fields are left blank before the form is finalized.

18

Performs a final review of the entire form for accuracy and completeness before it is considered ready for filing

Conducts a comprehensive review of the entire form to ensure all required information is present and correctly entered. The software scans each field for common errors, such as incomplete sections, incorrect formatting, or inconsistent data entries. It also prompts the user to review any fields that typically require manual verification. This final check is designed to minimize the risk of the form being rejected due to inaccuracies or incomplete information, thereby streamlining the filing process.

Common Mistakes in Completing Form 5329

Failing to attach Form 5329 to the tax return when required can lead to processing delays and potential penalties. It is crucial to understand when this form is necessary, such as when additional taxes on retirement plans or other tax-favored accounts are owed. Taxpayers should review the instructions for their tax return and Form 5329 to determine if attachment is necessary. To avoid this mistake, double-check the filing requirements and ensure that Form 5329 is securely attached to the tax return before submission.

When filing Form 5329 independently of a tax return, it is mandatory to sign and date the form to validate it. An unsigned or undated form may be considered invalid and can result in the IRS not recognizing the form, leading to unnecessary delays and possible penalties. Taxpayers should ensure that they sign and date the form in the designated area. Before mailing, it is advisable to review the form to confirm that all required signatures and dates are present.

Incorrectly calculating the additional tax as 10% of early distributions is a common error that can result in an inaccurate tax liability. The additional tax should be calculated based on specific IRS rules that may not always equate to a flat 10% of the distribution. Taxpayers should carefully read the instructions for Form 5329 and use the correct calculation method as outlined by the IRS. Utilizing tax software or consulting with a tax professional can also help ensure the accuracy of these calculations.

Omitting the exception number for distributions not subject to the additional tax can lead to the IRS incorrectly assessing additional taxes. It is important to identify and enter the appropriate exception number on Form 5329 to indicate that the distribution is not subject to the additional tax. Taxpayers should review the list of exceptions provided in the form's instructions and accurately report the applicable exception number. Careful attention to detail when completing this section can prevent unnecessary correspondence with the IRS.

Miscalculating the amount subject to additional tax by not properly subtracting line 2 from line 1 in Part I can result in an incorrect tax amount being reported. This mistake can occur if taxpayers overlook the need to subtract certain contributions or distributions that are not subject to the additional tax. To avoid this error, it is essential to follow the calculation instructions on Form 5329 carefully and ensure that all arithmetic is done correctly. Reviewing the form for accuracy or seeking assistance from a tax professional can help prevent this type of error.

Taxpayers often overlook the requirement to report additional taxes from qualified plans on Schedule 2 (Form 1040), line 8. This omission can lead to underreporting of tax liability and potential penalties. To avoid this mistake, carefully review all distributions from qualified plans and ensure any additional taxes are calculated as per the instructions for the form. Double-check that these amounts are correctly entered on Schedule 2, line 8, before filing your tax return.

Incorrectly reporting the amount of distributions from education accounts, such as 529 plans or Coverdell ESAs, can result in inaccurate tax calculations. It is essential to maintain accurate records of all distributions and their purposes. Verify that the distribution amounts used in your tax calculations match your financial records. Ensure that the distributions used for qualified education expenses are reported correctly to avoid unnecessary additional taxes.

Taxpayers sometimes fail to calculate and report the 6% additional tax on excess contributions to traditional IRAs. This error can occur if contributions exceed the allowable limits or if the taxpayer's income is too high for deductible contributions. To prevent this mistake, monitor your contributions throughout the year and compare them against the annual limits. If you have over-contributed, withdraw the excess amount before the tax filing deadline to avoid the additional tax.

Reporting additional tax on excess contributions to Roth IRAs can be complex due to the specific rules governing these accounts. Ensure that you understand the contribution limits and phase-out ranges based on your modified adjusted gross income. If you contribute more than the allowed amount, you must calculate and report a 6% tax on the excess contributions. Use the correct forms and worksheets to determine any additional tax owed and report it accurately on your tax return.

When contributing to Coverdell Education Savings Accounts (ESAs), it is crucial to avoid exceeding the annual contribution limits. Miscalculating the additional tax due on excess contributions is a common error. To avoid this, track your contributions to ensure they do not surpass the limit for the tax year. If you do contribute too much, the excess must be withdrawn or subject to a 6% excise tax. Use the appropriate IRS forms and instructions to calculate any additional tax accurately.

Incorrect calculation of additional tax on excess contributions to Archer Medical Savings Accounts (MSAs) can lead to reporting errors on the form. To avoid this mistake, individuals should carefully review the contribution limits for the tax year and use the instructions provided in the form to calculate the additional tax accurately. It is advisable to double-check the math and consider using tax preparation software or consulting with a tax professional to ensure the calculations are correct. Keeping detailed records of all contributions throughout the year can also help prevent this error.

Omitting the additional tax on excess contributions to Health Savings Accounts (HSAs) is a common oversight. Taxpayers should be vigilant in tracking their contributions to HSAs to ensure they do not exceed the annual limit. If excess contributions are made, it is crucial to report the additional tax owed on the form. Taxpayers can avoid this mistake by reviewing the contribution limits, correcting excess contributions before the tax filing deadline, and using the instructions on the form to report any additional tax due.

When it comes to Achieving a Better Life Experience (ABLE) accounts, not calculating the additional tax on excess contributions correctly can result in reporting inaccuracies. Taxpayers should familiarize themselves with the specific contribution limits for ABLE accounts and use the form's instructions to determine any additional tax liability. To prevent errors, it is recommended to monitor contributions throughout the year, promptly address any excess contributions, and seek assistance from tax preparation resources or professionals if needed.

Reporting the additional tax on excess accumulation in qualified retirement plans inaccurately can have significant consequences. Taxpayers should ensure they understand the requirements for minimum distributions and the tax implications of any accumulations beyond these amounts. To avoid mistakes, individuals should carefully calculate the required minimum distributions, report any excess accumulations accurately, and consult the form's instructions or a tax advisor for guidance. Regular review of retirement account statements can also help in maintaining accurate records.

If a paid preparer is used, their failure to sign, date, and provide their information on the form is a procedural error that can lead to processing delays. To ensure compliance, paid preparers must remember to provide their signature, the date of completion, and their relevant information in the designated sections of the form. Taxpayers should verify that their preparer has completed these steps before submitting the form. It is also important for taxpayers to choose a reputable and reliable tax preparer who understands the importance of these details.

Failing to review the entire form for accuracy and completeness before signing can lead to errors or omissions that may result in penalties or delays in processing. It is crucial to double-check all entries and ensure that every required section is filled out correctly. Cross-referencing the information provided with personal financial records can help verify accuracy. It is also advisable to have a second pair of eyes, such as a tax professional, review the form before submission.

Submitting Form 5329 independently when not eligible is a common error that can cause complications with the IRS. Taxpayers should understand the specific circumstances under which Form 5329 should be filed separately. In most cases, this form accompanies the taxpayer's standard tax return. To avoid this mistake, taxpayers should carefully read the instructions regarding eligibility for separate filing and consult with a tax advisor if there is any uncertainty.

Neglecting to follow the detailed instructions for each part of the form can result in incorrect or incomplete entries, which may lead to penalties. It is essential to read and understand the instructions for each section before filling out the form. If there is any confusion, taxpayers should seek clarification from the IRS guidelines or a tax professional. Taking the time to comprehend each step can prevent costly errors and ensure compliance with tax regulations.

Misunderstanding the form's requirements often leads to entering incorrect information, which can have serious consequences, including fines or an audit. To avoid this, taxpayers should familiarize themselves with the form's terminology and requirements before beginning the process. Utilizing IRS resources or consulting with a tax professional can provide clarity. Additionally, taxpayers should not rush through the form and should take the time to carefully read each question and its instructions.

Omitting to report the correct amounts on the corresponding lines of the form can result in an inaccurate tax calculation and potential penalties. Taxpayers should ensure that all amounts entered on the form are accurate and correspond to the correct lines as indicated by the instructions. Double-checking figures against financial statements or previous tax returns can help ensure accuracy. It is also beneficial to use a calculator or tax software to prevent simple arithmetic errors.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 5329 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 5329 forms, ensuring each field is accurate.